Demat accounts for millennials have become a powerful tool in reshaping the landscape of personal finance and investing. If you’re wondering how to create a Demat account, especially with the keyword “how to create Demat account,” and are interested in tracking HDFC Bank Share Price, this article will provide insights into how millennials are leveraging these accounts to start investing on their terms.

Digital Transformation: Millennials, born between the early 1980s and the mid-1990s, are the first generation to come of age in the digital era. They are tech-savvy, comfortable with online platforms, and value the convenience of managing their finances digitally. If you’re considering how to create a Demat account, the process aligns perfectly with this digital mindset, offering a paperless and hassle-free way to hold and trade securities.

Accessible Investing: Demat accounts have dismantled barriers to entry for millennials in the world of investing. If you’re curious about how to create a Demat account, it’s worth noting that traditional investment avenues often require substantial capital, making it challenging for young investors to participate. With Demat accounts, millennials can start investing with smaller amounts, allowing them to gradually build their portfolios and benefit from the power of compounding over time.

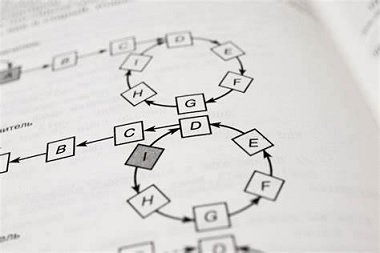

Diverse Investment Options: For those wondering how to create a Demat account and interested in exploring HDFC Bank Share Price, Demat accounts provide diversity and choice. These accounts allow investors to hold a variety of securities, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). The flexibility to diversify their portfolios according to their risk tolerance and investment goals is a key appeal for millennials seeking a well-rounded and resilient investment strategy.

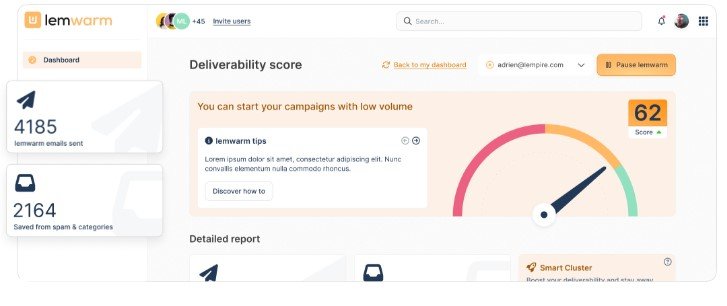

Real-Time Tracking and Monitoring: If you’re contemplating how to create a Demat account and are keen on tracking HDFC Bank Share Price, one of the significant advantages is the ability to monitor investments in real time. Mobile trading apps associated with Demat accounts offer real-time market updates, stock prices, and portfolio tracking features. This real-time accessibility empowers millennials to stay informed, make timely decisions, and adapt their investment strategies based on market trends.

Cost-Effective Trading: Millennials, known for their cost-conscious approach to finances, benefit from cost-effective trading solutions with Demat accounts. If you’re interested in how to create a Demat account, note that these accounts offer lower brokerage fees compared to traditional methods. This affordability encourages millennials to engage in more frequent and strategic trading activities without incurring exorbitant costs.

Educational Resources: For millennials new to investing and considering how to create Demat account, these accounts often come with educational resources and research tools. These resources help investors understand market dynamics, financial instruments, and investment strategies. Information availability empowers millennials to make informed decisions and take an active role in shaping their investment portfolios.

Social Connectivity and Learning: Millennials thrive on connectivity and social interaction. If you’re curious about how to create Demat account, note that some Demat account platforms integrate social features, allowing investors to share insights, discuss market trends, and learn from each other. This social connectivity adds a collaborative dimension to investing, enabling millennials to benefit from collective wisdom and shared experiences within a community of like-minded investors.